Welcome to pdf run in this video we'll guide you on how to fill out ds-82 form ds-82 or u.s passport renewal application for eligible individuals is a two-page legal document that both u.s citizens and nationals use to renew passports by mail applicants may use this form if their us passport has expired or is near its end of validity date to begin filling out this document click on the fill online button this will redirect you to pdf runs online editor first mark the appropriate box to determine the type of passport you are applying for if you marked us passport book mark the appropriate box to determine the type you are applying for on the first page please answer the following items for item 1 enter your full legal name for item 2 provide your date of birth for item 3 mark the box corresponding to your gender for item 4 enter your place of birth for item 5 enter your social security number for item 6 enter your email address for item 7 provide your primary contact number for item 8 indicate your mailing address for item 9 if applicable list down all the legal names you may have used previously for item 10 please provide the following information from your most recent us passport name passport book number passport card number and their respective dates of issue for item 11 only answer this part if your current name is different from the one that you have in your previous us passport book or cart next mark the box corresponding to the type of name change you had then please indicate the place where you had the name change as well as the date on the second page start with entering the full legal name and...

PDF editing your way

Complete or edit your ds 82 form printable anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export ds 82 passport form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form ds 82 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your ds 82 passport renewal form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form DS-82

About Form DS-82

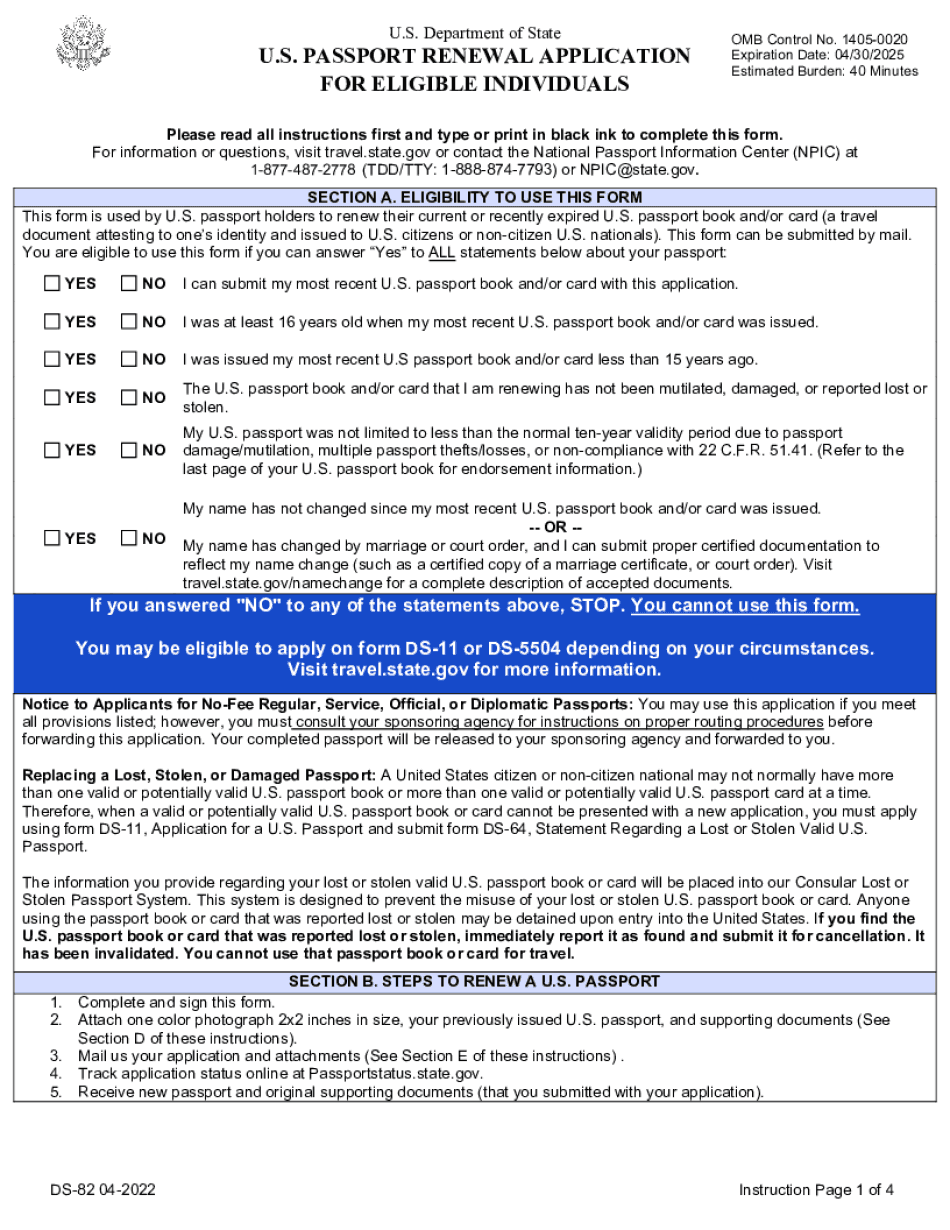

Form DS-82 is the U.S. Passport Renewal Application for Eligible Individuals. It is used by U.S. citizens who meet the eligibility criteria to renew their current U.S. passport by mail. In order to use Form DS-82, the applicant must currently hold a 10-year U.S. passport that is not damaged, lost, or stolen, issued when the applicant was 16 years or older, and issued in the last 15 years. The applicant must also have had a name change, if applicable, documented through a court order, marriage certificate, or divorce decree. Overall, Form DS-82 is used by U.S. citizens who are looking to renew their U.S. passport by mail, without having to go in person to a U.S. embassy or consulate.

What Is Ds 82 Form Printable?

Form DS-82 is an Application Form for a Ds 82 Form Printable. It is important to know that an applicant must fill out DS-82 before expired date of a DS 82 taking into account document processing time. First a person needs to download an appropriate printable sample and insert required information. While preparing a document you need strictly follow specified instructions. For successful processing of a form fill in all empty boxes in a document. There is list of supplementary documents that you have to attach to DS-82 (i.e. most recent US DS 82 book, certified copy of a marriage certificate, recent colour photo).

Remember that U.S. Ds 82 Form Printable Application is only for Eligible Individuals, so before filling out a form make sure you are authorized to implement such procedure. After a document is complete, check if all data is true and correct and pay a filing fee to avoid further delay and rejection. Individuals who are not on the territory of the U.S. at the moment of filing have to apply to an agency in order to be provided with attorney. Do it with the help of authorization letter. You may fill in the form online or print and do it manually. On this website you can find various updated PDF samples of this form. It will take you just a few minutes to create a legal document and easily forward to the agency.

Online solutions assist you to arrange your document administration and boost the productiveness of your workflow. Follow the quick handbook to be able to total Form DS-82, refrain from errors and furnish it in a very well timed way:

How to finish a ds 82?

- On the website along with the variety, simply click Start off Now and pass towards the editor.

- Use the clues to fill out the relevant fields.

- Include your own details and call knowledge.

- Make confident that you choose to enter right info and numbers in appropriate fields.

- Carefully check out the content material from the variety in the process as grammar and spelling.

- Refer to assist part if you've got any questions or tackle our Assistance crew.

- Put an electronic signature on your Form DS-82 when using the guidance of Sign Instrument.

- Once the form is completed, push Undertaken.

- Distribute the prepared sort through email or fax, print it out or preserve on your machine.

PDF editor lets you to make alterations towards your Form DS-82 from any World Wide Web related equipment, personalize it as reported by your preferences, signal it electronically and distribute in various options.

What people say about us

Become independent with electronic forms

Video instructions and help with filling out and completing Form DS-82